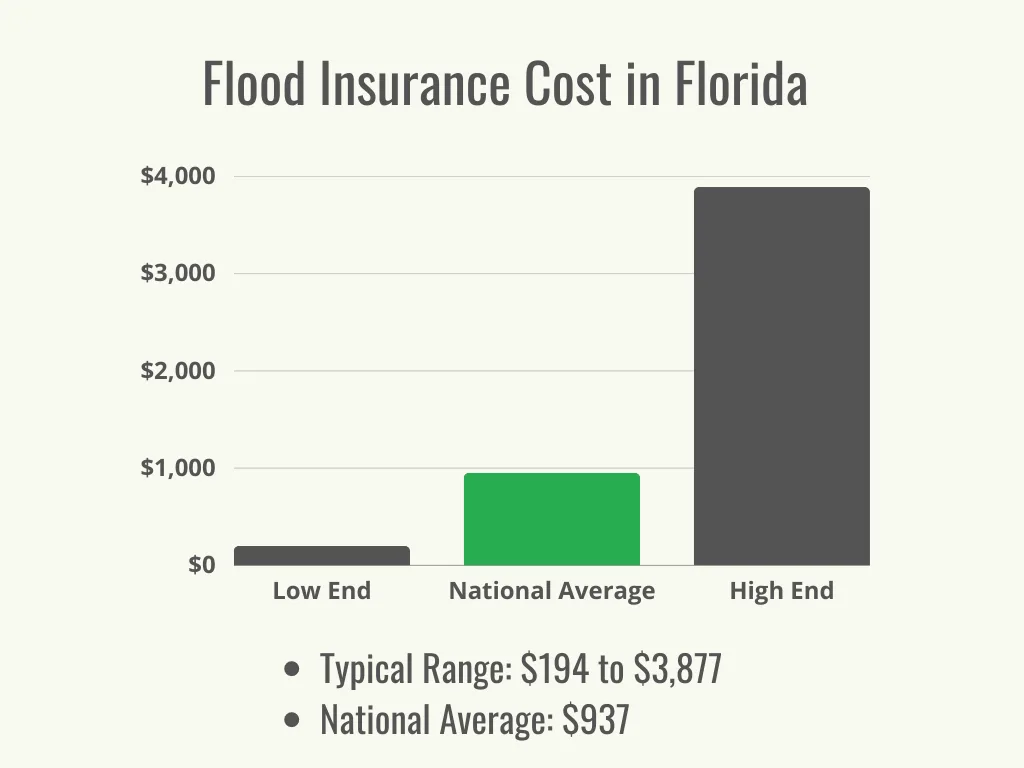

The flood insurance cost in Florida is higher in 2026 than many homeowners expected. New risk data, updated pricing models, and rising repair costs all influence today’s rates. This article shares the latest averages and explains what those numbers mean, using clear and simple language.

What Is the Average Flood Insurance Cost in Florida in 2026?

The flood insurance cost in Florida in 2026 varies by location and risk level. Most homeowners pay a yearly premium that reflects updated risk scoring and local flood exposure. The average costs of flood coverage are higher in high-risk areas and lower in low-risk zones. Elevation, home type, and proximity to water all affect the final number.

Why Flood Insurance Costs Increased in Florida Entering 2026

Flood insurance costs increased heading into 2026 for clear reasons. FEMA updated the method for measuring risk under risk rating 2.0. Claims data became more precise.

Construction and repair costs also rose. These changes adjusted the pricing of homes, even in areas without recent flooding.

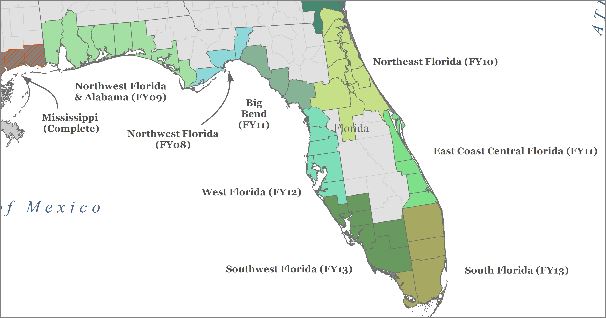

Flood Insurance Cost by Flood Zone in Florida

Flood insurance pricing changes by flood zone because risk levels are different. Homes in high risk flood zones usually pay more because of stronger flood probability. Lower-risk areas often see reduced premiums. For a clear explanation of lower-risk areas, see Flood Zone X, which helps explain how zoning connects to cost.

Average Flood Insurance Cost in Flood Zone X

Homes in Flood Zone X typically have lower premiums. These areas face less frequent flooding. Many homeowners still choose coverage for added protection, even when they do not require it.

Average Flood Insurance Cost in High-Risk Flood Zones (AE & VE)

High-risk zones like AE and VE carry higher premiums. These areas have a greater chance of flooding. Insurance pricing reflects stronger exposure and higher potential damage.

Why Flood Zone Classification Affects Premiums

Flood zones measure a property’s flood risk. Factors include elevation, nearby water, and past flood data. Higher risk leads to higher insurance pricing.

Flood Insurance Cost for Waterfront Homes vs Inland Homes

Waterfront homes usually face a higher chance of flooding than inland properties. Water proximity increases exposure. This often leads to higher premiums. Inland homes tend to experience lower rates because they face reduced flood risk.

In places like Cape Coral waterfront homes, buyers should expect insurance costs to reflect water access. Potential flood damage plays a key role in pricing.

Why Waterfront Homes Cost More to Insure

Waterfront properties face more frequent water-related risks. Storm surge, heavy rain, and tidal changes matter. Insurers price these risks into premiums.

Canal-Front and Gulf-Access Home Insurance Factors

Canal-front and gulf-access homes add another layer of exposure. Open water flow can raise flood potential. This directly affects insurance pricing.

Average Flood Insurance Cost by Home Type in Florida

Insurance costs also depend on home structure. A key factor is the lowest floor level. Homes built higher often qualify for lower premiums.

Interior features like water heaters matter too. Ground-level systems increase risk. Homes near water, including some lakefront homes, may see added cost differences based on layout.

Flood Insurance Cost for Single-Family Homes

Single-family homes vary widely in cost. Size, elevation, and location all matter. We evaluate risk individually.

Flood Insurance Cost for Condos and Townhomes

Condos often have lower premiums. Shared structures and higher living floors reduce exposure. Coverage is usually more limited.

Flood Insurance Cost for New Construction vs Older Homes

Newer homes often meet modern flood standards. Older homes may lack elevation or updated materials. This can increase insurance costs.

Private Flood Insurance vs NFIP Costs in Florida (2026)

Florida homeowners can choose between private policies and the national flood insurance program. Both options price risk differently.

The flood insurance program NFIP follows standardized pricing models. Private insurers may offer flexible coverage. For official numbers, refer to official FEMA flood insurance data.

Average NFIP Flood Insurance Cost in Florida

NFIP rates in Florida follow standardized pricing. Flood risk, elevation, and construction details determine the cost. Homes in higher-risk zones usually pay more. Lower-risk properties often see more stable pricing.

When Private Flood Insurance May Be Cheaper

Private flood insurance can cost less for some homes. This often happens with newer construction or elevated properties. Insurers may offer flexible pricing when risk factors are lower.

Key Coverage Differences Buyers Should Understand

NFIP policies follow fixed coverage limits. Private policies may offer broader options. Differences can include coverage caps, deductibles, and added protections. Buyers should review terms carefully before choosing.

Do You Need Flood Insurance in Florida in 2026?

Flood insurance is not always mandatory. Requirements depend on location and lender rules. Some standard home insurance policies do not cover flooding.

Many homeowners still speak with an insurance agent to understand their risk. Coverage decisions are often personal, not required.

What Flood Insurance Costs Mean for Buying Waterfront Homes in Florida

Insurance costs affect monthly budgets and long-term affordability. A property’s flood risk can influence total ownership expenses.

For buyers reviewing waterfront homes in Cape Coral, flood insurance becomes part of regular living expenses. Planning for it is a cost, not an unexpected event.

Can Florida Homeowners Lower Their Flood Insurance Cost in 2026?

Some homeowners can reduce their flood insurance premium. Small changes can lower the overall costs of flood insurance.

Elevation Certificates and Mitigation Options

Elevation certificates show how high a home sits above flood levels. Higher elevation often means lower premiums.

Home Improvements That May Reduce Premiums

Flood vents and raised utilities help reduce risk. These upgrades can improve insurance pricing.

Comparing Flood Insurance Providers in Florida

Different providers price risk differently. Comparing options may lead to savings.

How Flood Insurance Costs Affect Home Buying in Florida

Flood insurance can influence home buying decisions. Buyers often review flood maps early in the process.

In areas with complicated water systems, tools like the Cape Coral canal map are useful. They help buyers understand location-based risks. This information is important before making a decision.

Is Flood Insurance Cost a Dealbreaker for Florida Waterfront Buyers?

For some buyers, cost feels discouraging at first. A past flood insurance claim can raise concerns. Others see insurance as a manageable part of ownership.

When reviewing Cape Coral waterfront properties, many buyers weigh lifestyle benefits against added insurance costs. For most, it’s a balance, not a dealbreaker.

What Experts Expect for Florida Flood Insurance Costs in 2027

Experts expect gradual adjustments rather than sudden jumps. Pricing will continue to follow risk data and claims history.

Long-term future flood insurance trends point toward steady refinement. Buyers and homeowners should expect changes, but not unpredictability.

FAQs

Is flood insurance required for all Florida homeowners?

No. Requirements depend on flood zone and lender rules. Some homeowners choose coverage even when it’s optional.

Did flood insurance rates increase everywhere in Florida in 2026?

Not everywhere. Some low-risk areas saw smaller changes, while high-risk zones experienced higher increases.

Can homeowners switch between NFIP and private flood insurance?

Yes. Many homeowners compare both options to see which fits their risk and budget better.

Does flood insurance cover temporary living expenses?

Some policies include limited coverage for living expenses, but this depends on the provider and policy type.