Buying near water should feel exciting, not stressful. People often mention Flood Zone X during the process, and it can sound more complicated than it actually is. This guide helps waterfront buyers who want calm flood risk awareness, clear thinking, and confidence before taking the next step.

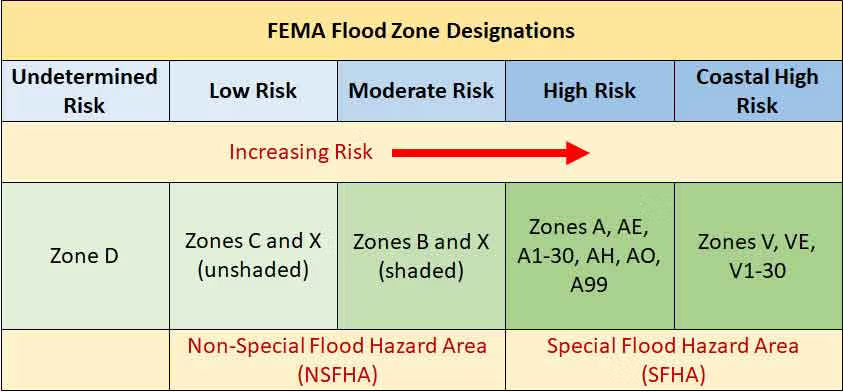

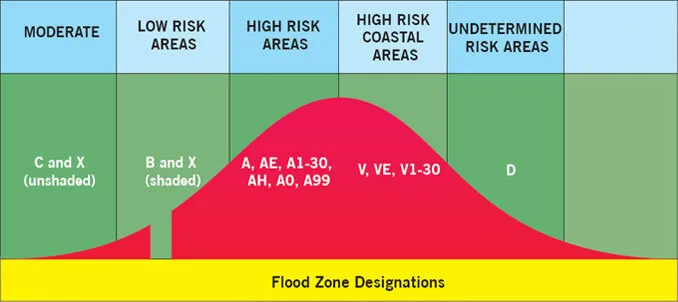

What Is Flood Zone X?

Flood Zone X is a flood zone classification used by FEMA to describe areas with lower flood risk compared to high-risk zones. It sits outside the main floodplain. It uses elevation, mapping data, and long-term flood history. This helps buyers feel clearer and more confident.

Is Flood Zone X Considered Low Risk?

Yes, many people generally view it as having a lower flood risk compared to many other zones. Flood risk is lower because of elevation and location. However, buyers should be realistic and not assume flooding will never occur.

Why “Low Risk” Does Not Mean “No Risk”

Lower risk does not equal zero risk. Heavy storms, drainage problems, or unusual weather can cause flooding. This is why knowing local conditions is important for long-term peace of mind.

Does Flood Zone X Require Flood Insurance?

In most cases, mortgage lenders do not require flood insurance in Flood Zone X. This is because experts consider the flood risk lower. Still, rules can vary by lender, loan type, and location.

When Flood Insurance May Still Be a Smart Choice

Some buyers choose coverage for peace of mind. Heavy rain, storms, or changing conditions can still cause damage. Optional insurance can help protect a waterfront investment without pressure or fear.

Can Waterfront Properties Be in Flood Zone X?

Yes, some waterfront properties can be in Flood Zone X. This depends on their height and how far they are from significant flood sources. In places like the waterfront homes in Cape Coral, flood zones can differ by neighborhood. They do not only depend on how close you are to the water.

How Elevation and Location Affect Waterfront Flood Zones

Higher elevation levels and well-planned drainage often place certain waterfront homes outside high-risk zones. This variation explains why two nearby properties can fall into different flood classifications, reducing common buyer assumptions.

Flood Zone X vs AE: What Buyers Should Know

This flood zone comparison helps buyers understand risk more clearly. People consider Flood Zone X to be lower risk.

In contrast, Zone AE is a higher risk area. It has stricter building and insurance rules. Knowing the difference helps buyers stay realistic and informed.

Key Differences That Impact Buying Decisions

The biggest difference comes down to risk level and cost. Higher-risk areas usually need insurance and have stricter rules. Lower-risk areas provide more flexibility, which many buyers find easier to handle over time.

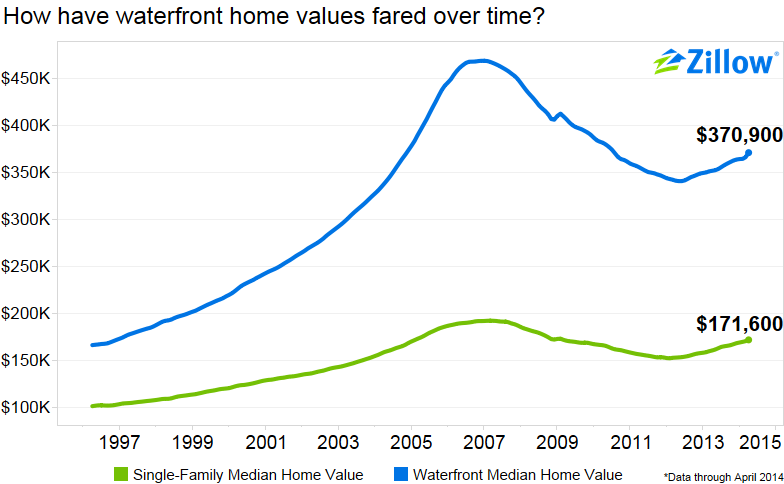

How Flood Zone X Can Affect Property Value

Lower flood risk often supports stronger property value over time. Homes in Flood Zone X may attract more buyers because insurance costs and perceived risk are usually lower. This can also improve resale potential, especially when buyers compare waterfront options like lakefront homes.

Why Buyers Often Prefer Lower-Risk Flood Zones

Buyers tend to feel more confident when risk feels manageable. Lower-risk zones lower uncertainty and help with budgeting. They also create peace of mind. This peace of mind is important for long-term buying decisions.

Is Flood Zone X Good for Long-Term Waterfront Living?

For many buyers, the answer is yes. Lower risk supports long-term living by reducing stress and unexpected costs. A stable waterfront lifestyle feels more enjoyable when risk feels manageable and predictable.

Homes built for easy water access, like those with boat docks, mix comfort and practicality. This helps buyers feel sure about living there for a long time.

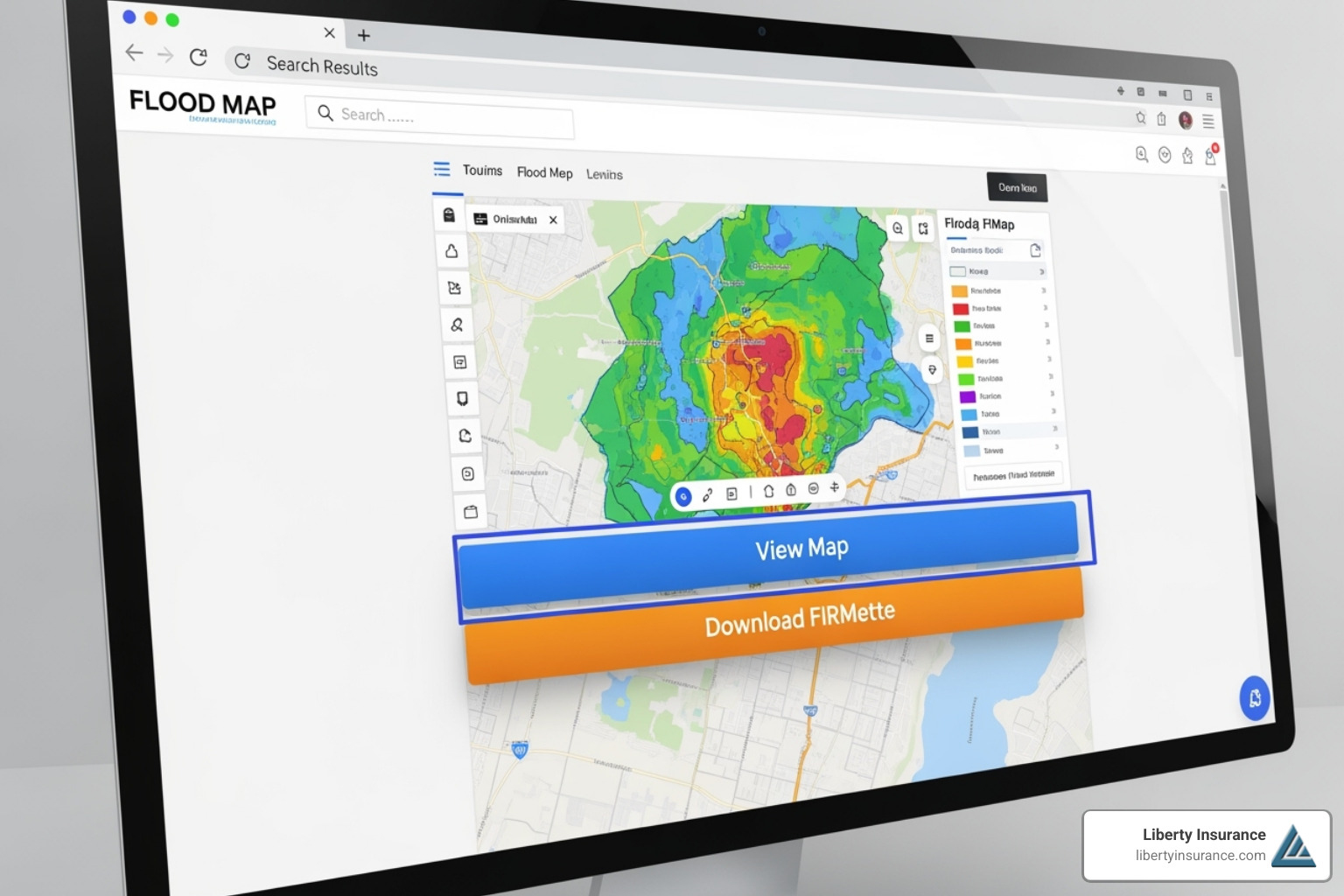

How to Check If a Property Is in Flood Zone X

A simple first step is to understand how FEMA defines flood zones before checking any address. Reviewing a trusted flood zone map source helps buyers know what Flood Zone X represents and how a property address check works in practice. This reduces confusion before diving into technical details.

For clear, official guidance, buyers can refer to official flood zone maps from FEMA. This page provides information about flood zones, mapping updates, and how experts determine flood classifications.

What Buyers Should Review Before Making an Offer

Before making an offer, buyers should check the flood zone label. They should also review elevation information and ask about any past flooding. Doing this early supports a calm, confident decision and avoids last-minute surprises.

Why Understanding Flood Zone X Matters Before Buying Waterfront Homes

Understanding Flood Zone X helps waterfront buyers make an informed decision without fear or pressure. When risk feels clear and manageable, buyers can focus on lifestyle, comfort, and long-term plans instead of uncertainty.

If you are looking for options, check out Cape Coral waterfront homes for sale. This can help you compare locations and find a home that fits your needs.

How Flood Zone X Influences Financing and Loan Approval

Flood zones can affect mortgage approval and loan requirements, even in lower-risk areas. Lenders often review flood classifications to assess risk, which can influence terms and documentation. Understanding this early helps buyers prepare and move forward with confidence.

How Flood Zone X Impacts Future Planning and Home Improvements

Flood zones can influence plans like renovations, additions, or rebuilding. Even in lower-risk areas, local rules and flood guidelines may affect permits, elevation requirements, or design choices. Knowing this early helps buyers plan smarter and avoid surprises later.

How Flood Zone X Affects Renovation and Expansion Plans

Flood zones can influence what changes you can make to a home over time. Even in lower-risk areas, renovation rules may depend on elevation, local codes, or flood guidelines. Understanding this helps buyers plan upgrades with fewer delays and better long-term flexibility.

conclusion

Buying near water should feel confident and exciting. Understanding Flood Zone X gives waterfront buyers clarity, reduces uncertainty, and supports smarter choices. When you understand the risk, you can focus on your lifestyle and comfort. This helps you make long-term plans with peace of mind and confidence in every step you take.

FAQs

1. How does FEMA update flood zone designations like Flood Zone X?

FEMA periodically reviews maps using new data, elevation models, and weather trends. Buyers should check the latest updates before closing.

2. Can climate change shift a property out of Flood Zone X?

Yes. Rising sea levels and increased rainfall patterns can change flood classifications over time, so buyers should monitor updates.

3. Do insurance premiums vary even inside Flood Zone X?

They can. Even within lower-risk zones, factors like elevation, storm history, and community ratings can affect cost.

4. Is Flood Zone X treated differently in loan underwriting than high-risk zones?

Yes. Lenders usually ask for stricter documents and higher reserves in high-risk areas. Flood Zone X often has more flexibility.

5. How often should buyers re-check flood zones after purchase?

A good idea is to check flood zone maps every few years. Do this before making significant alterations, as local conditions and maps can change.