5 bedroom homes under 300K dollars in Florida are rare — but not impossible. If you’re searching for more space on a budget, you’ll need to look beyond coastal hotspots…” If you’re searching for more space on a budget, you’ll need to look beyond coastal hotspots and focus on emerging inland markets. The good news? […]

Affordable Waterfront Homes in Cape Coral: Your Guide to Cape Coral Waterfront Homes for Sale If you’re searching for Affordable Waterfront Homes in Cape Coral, you’ll discover options that are both budget-friendly and smart investments. Right here’s the direct answer: yes — there are Cape Coral waterfront homes for sale at reasonable price points, especially […]

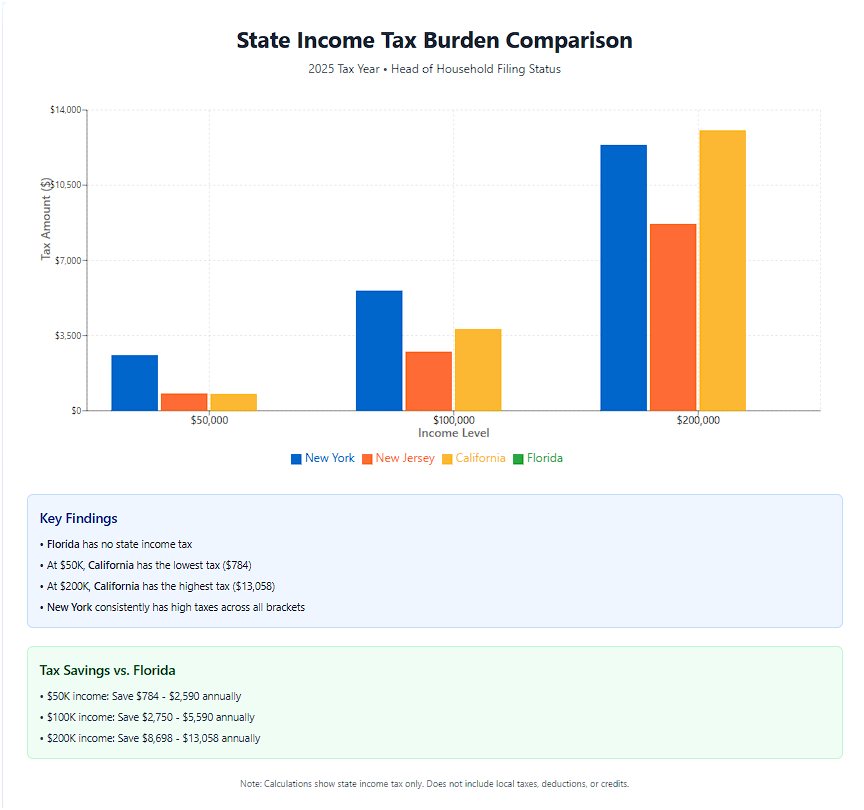

Save $15,000 Annually: Complete Florida Tax Benefits Guide When people think about moving to South Florida, the first things that come to mind are beaches, year-round sunshine, and a vibrant lifestyle. But what many overlook is just how much money you can save by living here. These Florida Tax Benefits significantly enhance the financial landscape […]

If you’ve been searching for Miami waterfront properties, you’ve probably noticed the price tags can range from jaw-dropping to “wait, that’s actually it?”—and wondered what you actually get for your money in 2025. Here’s the thing: I just spent weeks analyzing over 500 Miami waterfront sales, and what I found might surprise you. The Miami […]

Sunshine State Living

By Harry in Blog with 0 Comments

At US Prime Realty, we believe that informed decisions lead to successful outcomes. That’s why we’ve created this comprehensive resource hub where you can access the latest market data, neighborhood guides, investment strategies, and industry trends that matter most to South Florida property buyers, sellers, and investors. Our team of experienced real estate professionals brings […]