Updated for 2026 buyers based on current Cape Coral new construction trends.

Buying new construction homes in cape coral often looks straightforward at first.

The price seems clear, and everything feels new. But in 2026, buyers should expect additional costs beyond the base price. Understanding these costs early helps set realistic expectations and avoid surprises later in the process.

What extra costs come with new construction homes in Cape Coral?

The final cost of a home in Cape Coral is often higher than the starting price. Buyers usually pay extra for upgrades, utility setup, landscaping additions, and fees that appear during or after construction. These costs are normal, but they are not always clear at the beginning, which is why planning ahead matters.

Are builder upgrades worth the cost?

Builder upgrades can be worth it, but not all of them add real value. Some upgrades improve daily comfort, while others are mostly cosmetic. The key is understanding which builder upgrades solve long-term needs versus short-term preferences.

Common upgrades buyers choose in Cape Coral

Many buyers upgrade flooring, kitchen finishes, and bathroom features. Energy-efficient windows and insulation are also common choices. These upgrades are usually easier to add during construction than after move-in.

Which upgrades usually add long-term value

Structural and energy-related upgrades tend to hold value better over time. Items tied to efficiency or durability often matter more than design trends. Visual upgrades are still useful, but they are more about personal comfort than resale impact.

Do new construction homes include impact fees?

Sometimes yes, sometimes no. Impact fees depend on the builder, the lot, and local requirements, and builders do not always include them in the advertised price. Buyers should confirm this early, because these fees can affect the final cost.

How much more do lot premiums add?

Location, size, and surroundings determine lot premiums. Lots near water, on corners, or in areas like Mile Cove often cost more than standard lots. These premiums reflect demand and positioning, not construction quality.

Are HOA fees common in new construction homes?

HOA fees are common in many new construction communities. These fees usually cover shared spaces, neighborhood upkeep, and community amenities. Not every new home has HOA fees, but buyers should expect them in planned developments.

What utility setup costs should buyers expect?

Utility setup costs often appear close to move-in. These costs are easy to miss when focusing on construction but are part of getting the home ready to live in.

Water, sewer, and irrigation setup costs

Water and sewer connections may include activation or inspection fees. Irrigation systems often need final adjustments after construction is complete.

Electric, internet, and service connections

Electric and internet providers may charge setup or connection fees. You should usually plan for these one-time costs before move-in.

Is landscaping included with new construction homes?

Builders often include basic landscaping with a new build, especially for a single-family home. However, the base price usually does not include full designs, fencing, mature plants, and custom features. Buyers usually add these after closing.

Do new construction homes lower insurance costs?

New homes can qualify for lower home insurance rates. Updated materials and modern building codes reduce risk. Rates still depend on location, coverage level, and provider rules.

Will property taxes increase after construction?

Yes, property taxes usually increase after construction is complete. They reassess the land once they finish the home, and they apply the new value in the next tax cycle. This change often surprises first-time buyers.

This matters because it directly affects monthly ownership costs.

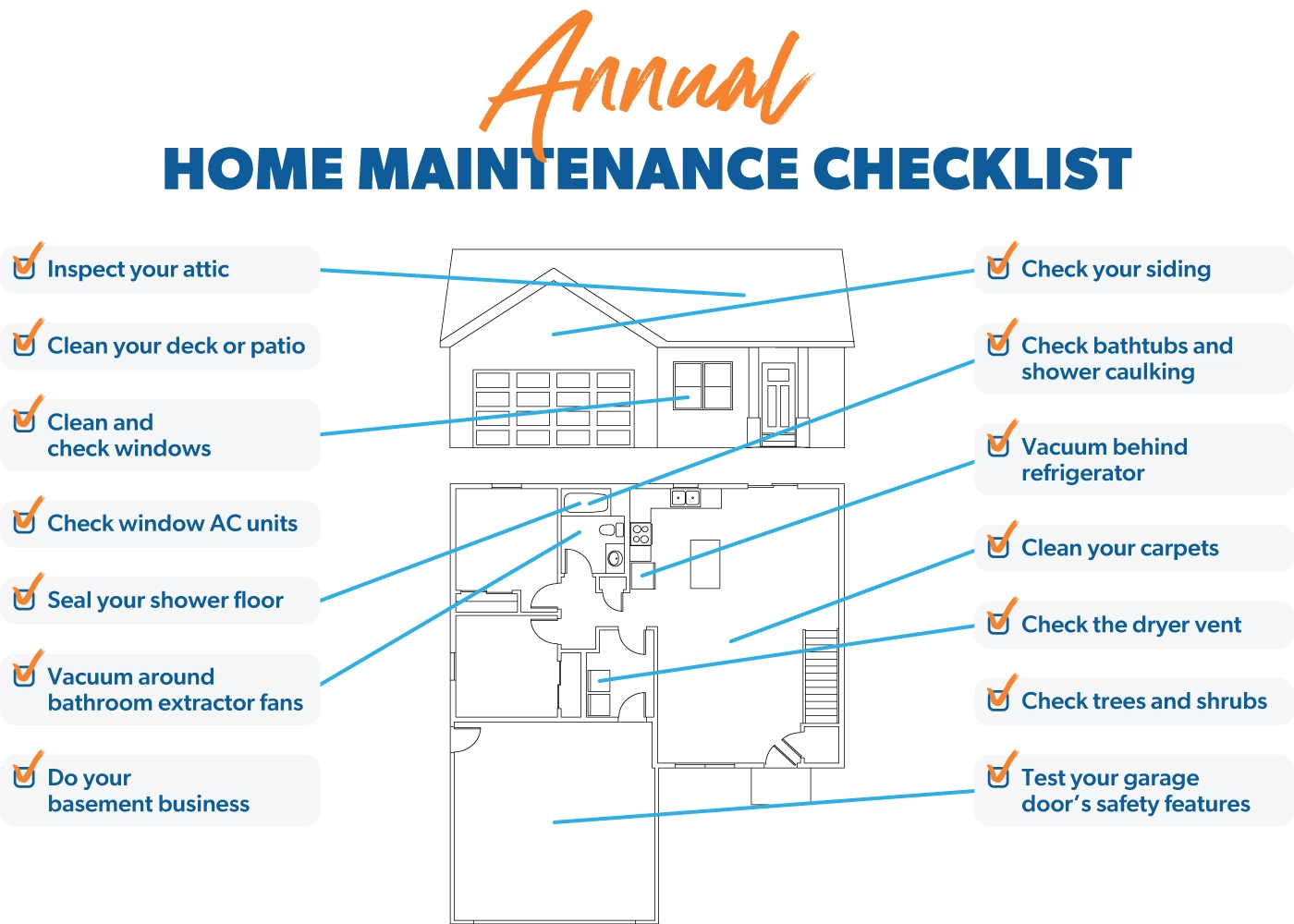

Are there maintenance costs with new construction?

New does not mean maintenance-free. While major systems are new, some upkeep still starts early. Homeowners often make small changes, do regular checks, and fix minor issues in the first year. This happens as the home settles and they use systems every day.

What builder warranties usually cover

Builder warranties often cover major systems and structural items for a limited time. Coverage length and details vary by builder.

What buyers still pay for

Routine upkeep, minor repairs, and wear items are usually not covered. Planning for these costs helps avoid frustration later.

How do construction timelines affect total costs?

Longer timelines can increase overall costs. Rate locks may expire, material prices can change, and delays may affect home offers tied to closing dates. Time often has a direct cost impact.

Delays can change both financing terms and final costs.

What costs change after the first year of ownership?

After the first year, some costs become more visible. Taxes, insurance adjustments, and regular maintenance often stabilize, giving buyers a clearer picture of long-term expenses.

This guide on buying new homes in Cape Coral in 2026 explains what to expect as inventory, pricing, and construction trends continue to change.

Buyers comparing inland options often review Cape Coral waterfront homes to understand how location changes long-term costs.

How do smart costs differ for waterfront and inland homes?

Costs often differ based on location. Waterfront homes may involve higher lot pricing, insurance considerations, and long-term upkeep compared to inland builds.

Buyers exploring Cape Coral waterfront homes should plan differently than those choosing inland properties. The setting changes both upfront and ongoing costs.

What market data says about building costs in 2026

Building costs continue to reflect labor, material, and compliance pressures. These factors influence pricing across new developments.

Industry data from U.S. home construction cost trends shows that cost stability remains a key concern entering 2026.

How location choices affect resale and long-term value

Location plays a major role in future value. Access, surroundings, and demand influence how a home performs over time.

Reviewing waterfront homes in Cape Coral alongside inland options helps buyers weigh cost versus long-term potential.

What smart cost planning means for buying in Cape Coral in 2026

Smart planning reduces uncertainty. Understanding these costs helps buyers move forward with confidence, not assumptions.

For buyers comparing options, waterfront real estate in Cape Coral can require a different budget approach than inland builds. Clear expectations make better decisions.

FAQs

Are new construction homes maintenance-free?

No. New homes need less early maintenance, but regular upkeep still begins within the first year.

What maintenance costs appear in the first year?

Minor fixes, inspections, and routine system checks are common.

Do builder warranties cover all repairs?

No. Warranties usually cover major systems, not routine maintenance or wear items.

Are waterfront new homes more expensive to maintain?

Yes. Moisture, exposure, and location factors often increase maintenance needs.