Save $15,000 Annually: Complete Florida Tax Benefits Guide

When people think about moving to South Florida, the first things that come to mind are beaches, year-round sunshine, and a vibrant lifestyle. But what many overlook is just how much money you can save by living here.

These Florida Tax Benefits significantly enhance the financial landscape for residents.

From retirees in Boca Raton to professionals in Brickell and investors in Palm Beach, Florida’s tax benefits are game-changers. The average newcomer relocating from New York, New Jersey, or California can realistically save $15,000 or more each year by taking advantage of the Sunshine State’s financial perks.

Understanding Florida Tax Benefits is essential for anyone considering relocation.

This isn’t a myth. Florida’s tax laws were designed to attract residents, retirees, and businesses — and if you know how to leverage them, the savings stack up quickly.

Let’s dive into the complete guide.

1. Florida Tax Benefits: No State Income Tax = Big Money Saver

These Florida Tax Benefits make it easier for families and professionals to thrive.

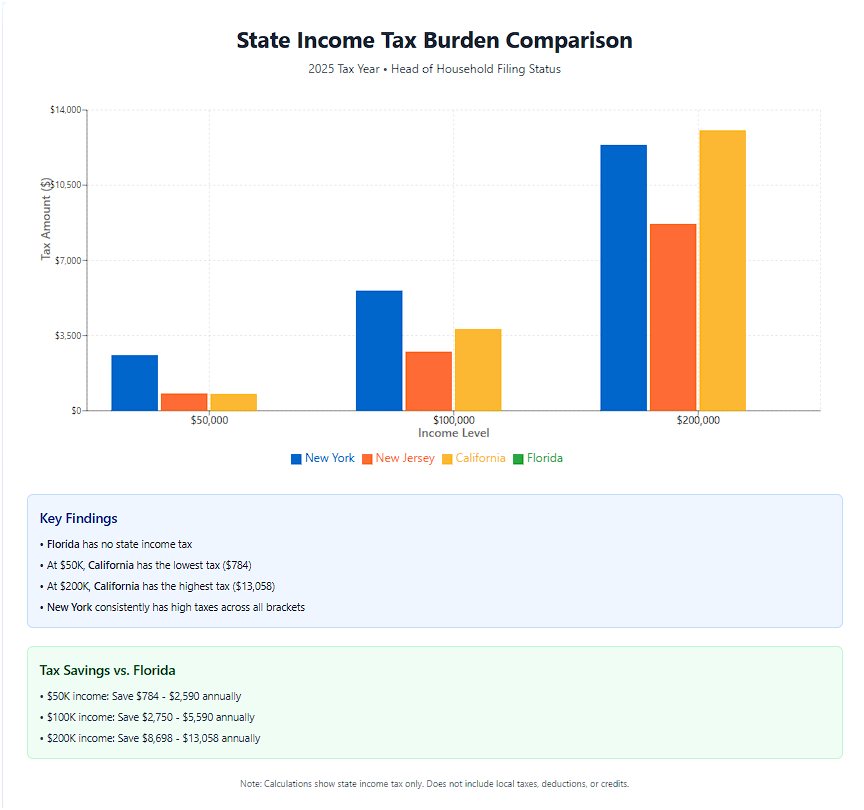

The number-one financial advantage is Florida’s zero state income tax. Unlike California (up to 13.3%), New Jersey (up to 10.75%), and New York (up to 10.9%), Floridians keep every cent of their wages, bonuses, and investment income.

Case Study: Miami Professional vs. Manhattan Professional

Manhattan resident earning $200,000: Pays around $13,500 in state income taxes annually.

Miami resident earning $200,000: Pays $0 in state income taxes.

That’s a $13,500 annual savings before even considering property tax perks.

State Income Tax Burden: NY, NJ, CA vs. FL (2025)

Head of Household filers at $50K, $100K, and $200K income levels

2. The Homestead Exemption: Protecting Homeowners

The Homestead Exemption is one of the key Florida Tax Benefits homeowners should know.

If you buy a primary residence in Florida, you can file for the Homestead Exemption, which reduces the taxable value of your home by $50,000.

In South Florida, where homes often range from $400,000 condos to multimillion-dollar estates, this exemption saves the average homeowner $750–$1,200 per year.

Example: Fort Lauderdale Homeowner

Home value: $500,000

Without exemption: Taxable at $500,000 → ~$4,500/year in property taxes

With exemption: Taxable at $450,000 → ~$4,050/year

Savings: $450 annually

And that’s just the start.

3. Save Our Homes Cap: Stopping Property Tax Inflation

Another critical aspect of Florida Tax Benefits is the Save Our Homes cap.

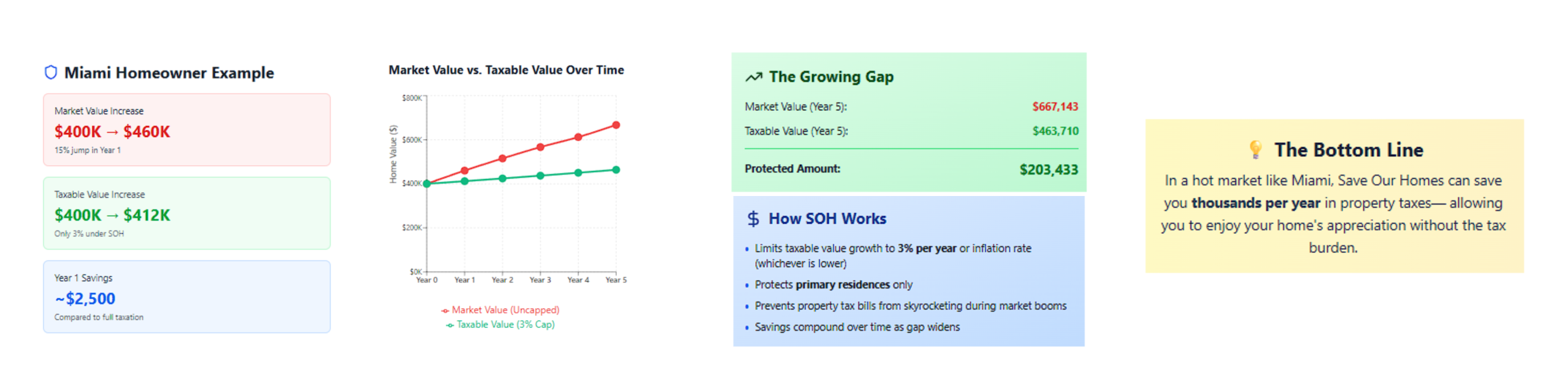

South Florida’s real estate market is famous for appreciation. A Miami home purchased for $400,000 might be worth $550,000 in just a few years. Without protection, property taxes could skyrocket.

Florida’s Save Our Homes (SOH) cap prevents that by limiting taxable value growth to 3% per year or the inflation rate, whichever is lower.

Example: Miami Homeowner

Market value increase: $400,000 → $460,000 (15% jump in one year).

Taxable value increase under SOH: $400,000 → $412,000 (only 3%).

Annual savings: ~$2,500 compared to full market taxation.

See how Save Our Homes caps your taxable value growth at 3% annually—protecting you from skyrocketing property taxes even as your home’s market value soars.

4. Portability: Take Your Savings With You

Portability is one of the most advantageous Florida Tax Benefits for long-term residents.

What if you upgrade to a bigger house in Boca Raton or downsize to a Delray Beach condo? Florida’s portability law allows you to transfer up to $500,000 of accumulated SOH benefits to your new home.

This means long-term homeowners can preserve their tax savings even when moving.

5. No Estate or Inheritance Taxes

Retirees especially benefit from these Florida Tax Benefits, providing a financial cushion.

Florida is a wealth-preservation haven. Unlike New Jersey or Massachusetts, which levy estate taxes, Florida imposes no estate or inheritance tax.

This makes it a top destination for retirees and high-net-worth families. Palm Beach County in particular has become a magnet for wealthy transplants who want to protect their legacies.

6. Retirement Income is Untaxed

Florida’s no-income-tax rule extends to all retirement income, including:

- Social Security

- Pensions

- 401(k) withdrawals

- IRA distributions

Case Study: Boca Raton Retiree

Annual retirement withdrawals: $90,000

If living in Connecticut: ~$5,000 in state taxes.

If living in Florida: $0.

Annual savings: $5,000.

7. Property Taxes: Lower Than Expected

Understanding the property tax landscape is crucial to leveraging Florida Tax Benefits.

Florida’s property tax rate averages 0.89% of home value, ranking in the middle nationwide. But thanks to the Homestead Exemption + Save Our Homes cap, long-term residents pay far less over time.

Case Study: West Palm Beach Homeowner

Home value: $600,000

Annual taxes after exemptions: ~$5,200

Comparable New Jersey home ($600,000): $13,000–$15,000 annually.

That’s nearly a $10,000 annual savings in property taxes alone.

8. Business & Investor-Friendly Climate

For entrepreneurs and real estate investors, Florida is equally attractive:

This friendly tax environment is among the top Florida Tax Benefits for businesses.

- No corporate income tax on S-corps and LLCs

- Low corporate tax rate (5.5%) for C-corps

- No inventory tax

This is why Miami is booming with startups, and Fort Lauderdale has become a hub for international business.

9. Sales Tax Exemptions

Florida’s sales tax is 6% (plus county surtaxes), but many essentials are exempt:

Recognizing the sales tax exemptions is vital to fully enjoy Florida Tax Benefits.

- Groceries

- Prescription drugs

- Residential rent (being phased out by 2026)

That means everyday living costs stay lower, even in high-demand areas like Brickell or Palm Beach.

10. The $15,000+ Annual Savings in Action

The cumulative impact of these Florida Tax Benefits can lead to substantial savings.

Let’s bring it all together with a practical example.

Case Study: New York Couple Relocating to Fort Lauderdale

- Household income: $200,000

- Home purchase: $600,000 primary residence

- Retirement contributions: $40,000 annually

Savings breakdown:

- No state income tax: $13,500

- Homestead Exemption: $1,000

- Save Our Homes cap: $2,500+ annually

- Property tax difference vs. NY/NJ: $7,000+

- Retirement income tax savings (future): $3,000–$5,000 annually

- Total savings: $15,000+ per year, every year.

Why South Florida Specifically?

While all Floridians benefit from these tax breaks, South Florida offers the best combination of financial perks + lifestyle upgrades:

So, whether you’re in Miami or Palm Beach, these Florida Tax Benefits are abundant.

- Miami: Global city with international investment opportunities.

- Fort Lauderdale: “Venice of America,” boating capital with waterfront real estate.

- Palm Beach: Luxury haven for retirees, business moguls, and wealthy transplants.

In each, the tax benefits supercharge property values and long-term wealth-building potential.

Final Thoughts: The Sunshine State Advantage

Living in South Florida isn’t just about sunshine and palm trees — it’s about financial freedom through remarkable Florida Tax Benefits. Between no income tax, homeowner protections, and estate-friendly policies, Florida residents save thousands every year.

For professionals, retirees, and investors alike, the $15,000+ in annual savings is real and measurable. Combine that with South Florida’s beaches, culture, and lifestyle, and it’s clear why so many people are making the move.